February 22, 2021

Retail trading activity continues to dominate market headlines and influence market liquidity dynamics. Growing retail volumes have caused drops in exchange share of trading activity, as a larger share of market activity occurs on a bilateral basis between retail brokers and market makers.

Exchanges have limited ability to truly compete for much of the volume executed by market makers away from the exchange. Much of this constraint is due to the service model offered by market makers, which includes bespoke price improvement and payment for order flow (PFOF) terms, as well as adjustments for disputed executions. However, exchanges are also on unequal footing when trying to fill an individual marketablei order; market makers trading off exchange can trade at price increments as small as $0.0001, while market makers contributing to price discovery on exchange must always quote in increments of $0.01.

In response to these commercial and regulatory limitations, NYSE Group has distinct offerings targeting retail order flow. These programs encourage competition for non-marketable limit orders obligated to display in the market and provide price improvement opportunities for marketable orders.

- Retail Liquidity Programs (RLP): on-exchange price improvement mechanism for attested retail flowii

- Retail Order Posting: exchange members with retail limit orders can display these on the exchange to meet their Limit Order Displayiii obligations and potentially receive enhanced economics

- Retail MPL IOC: exchange members can check NYSE and NYSE Arca midpoint liquidity at reduced rates

Retail Liquidity Program (RLP) Review

NYSE pioneered the RLP concept in 2012, and currently offers RLP for NYSE-listed securities on NYSE and all other securities on NYSE Arca. RLP allows non-displayed orders to offer price improvement to incoming retail orders.

- Any member can submit a Retail Price Improvement Order (RPI)

- RPI orders rest non-displayed on the NYSE or NYSE Arca book

- RPI orders can be submitted in $0.001 increments

- RPI orders must improve the best bid or offer by at least $0.001

- Resting RPI orders trigger messages on the SIP and proprietary data feeds indicating RPI interest with symbol and side but not price or size

- Exchange members with attested retail order flow can submit Retail Orders seeking to interact with RPI orders

- Retail Orders can be designated to

- trade only within the spread against RPI orders and other non-displayed orders, or

- trade first within the spread against RPI orders and other non-displayed orders and subsequently against displayed interest up to the limit price

- Retail Orders will always trade with the most-aggressively priced resting non-displayed order, regardless of RPI designation

- E.g., Retail Orders can trade with resting midpoint orders before executing against RPI orders that are priced between the near side and the midpoint

RLP Activity

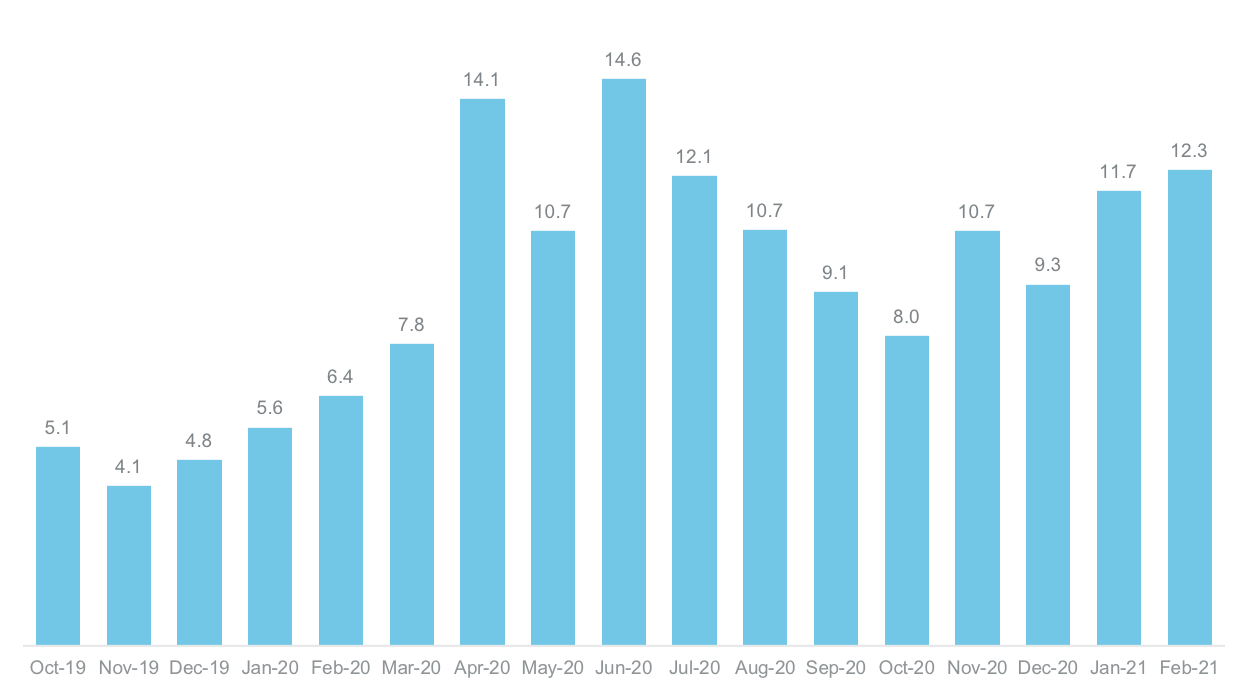

- RLP volume on NYSE and NYSE Arca has grown as retail volume has increased, but remains a small share of total market activity and total retail activity

NYSE and NYSE Arca Average Daily RLP Volume

(millions)

NYSE and NYSE Arca RLP: Top Symbols

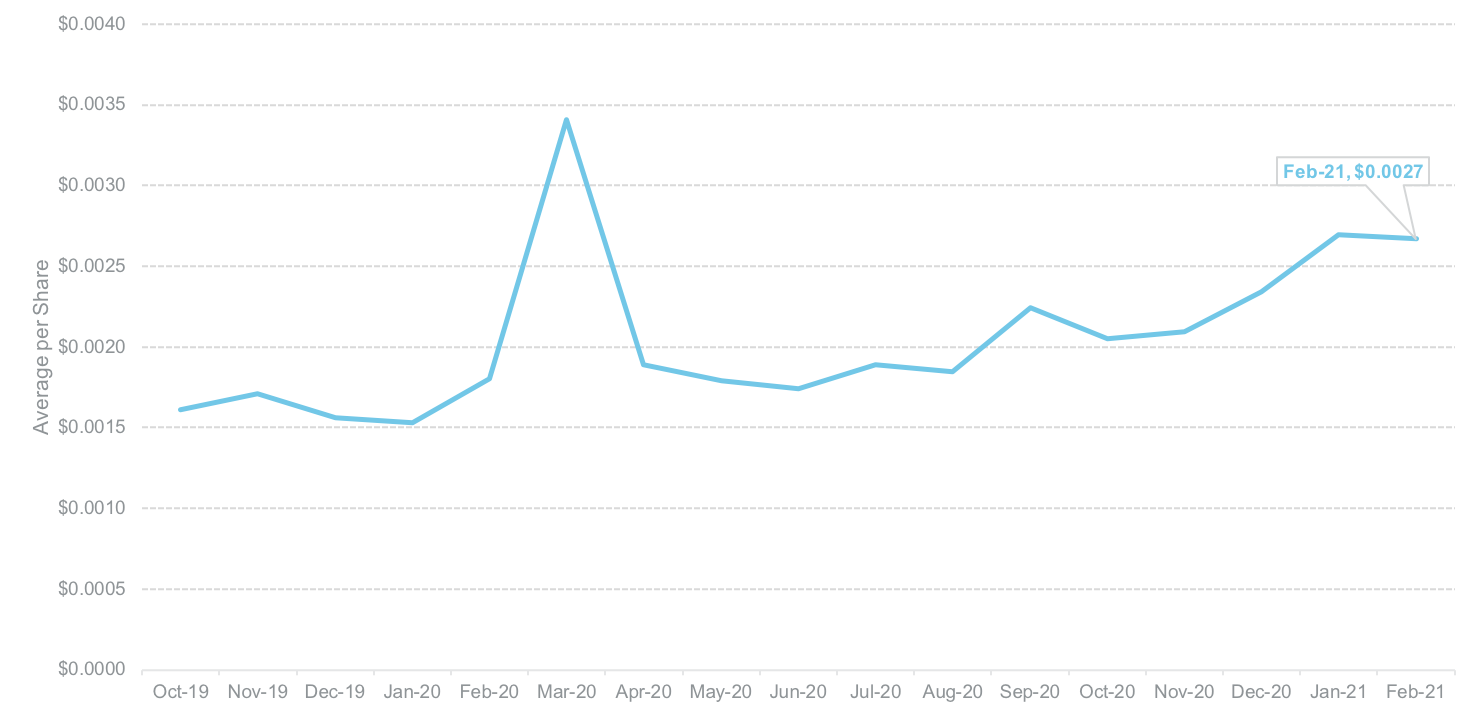

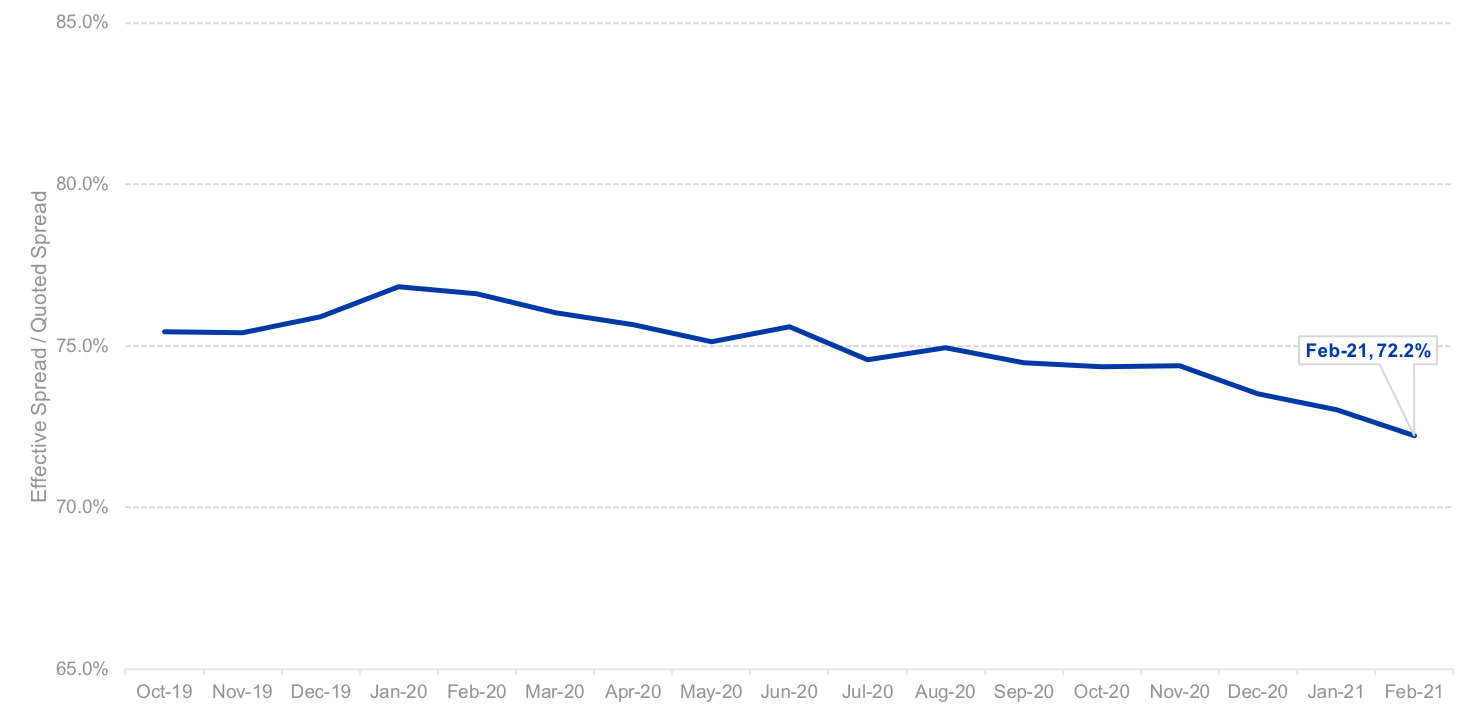

- As volumes have grown, NYSE & NYSE Arca RLP programs are providing higher per-share price improvement and a better effective spread / quoted spread metriciv

NYSE and NYSE Arca RLP Price Improvement

NYSE and NYSE Arca RLP Effective/Quoted

Exchange Limitations

One important constraint on RLP activity is the limited pre-trade pricing transparency. While resting RLP orders trigger a market data indication, there is no suggestion as to the available size or the amount of price improvement available from any given RPI order. This leaves firms with prospective RMO orders uncertain of the full benefit they could receive on any one particular order, making an off-exchange fill with higher average expected price improvement more favorable. Further, exchange RPI orders must move in increments of $0.001, which limits flexibility.

Conclusion

As retail participation remains high nearly one year into the pandemic, many market participants are seeking ways to interact with this liquidity. RLP offers a distinct all-to-all approach for interaction with marketable retail orders, leveraging the most flexible order pricing available on exchange. At the same time, the relatively limited growth in RLP volume during this period highlights an important constraint to exchanges competing for this order flow.

i“Marketable” refers to market orders and orders priced at or through the opposite best bid or offer

iiThe retail attestation definition is available at /publicdocs/nyse/markets/liquidity-programs/NYSE_Arca_Retail_Modifier_Attestation_Form.pdf

iiiSee https://www.sec.gov/fast-answers/answerstrdexbdhtm.html

ivEffective/quoted is a common execution quality metric for retail brokers. Further explanation available at https://us.etrade.com/trade/execution-quality