February 12, 2019

The jump in market volatility in 2018 has provoked several concerns regarding the nature of today's electronic trading environment. The NYSE's unique hybrid market model, which features a Designated Market Maker (DMM) obligated to provide liquidity and facilitate auctions, offers unmatched stability relative to other global markets, especially during times of market turbulence.

NYSE's auctions differ from those at other equities exchanges because they combine human judgment exercised by the DMM who oversees trading activity, with automated mechanisms. This enables NYSE to conduct a manual auction if deemed necessary by market conditions. To conduct the auction, the DMM aggregates buy and sell interest and executes the maximum volume at a price intended to be reflective of market supply and demand.

The manual auction therefore gives the DMM both price and time flexibility, unlike electronic auctions which because of their automated nature are more susceptible to large price dislocations due to temporary supply and demand imbalances — a scenario which occurred recently during an auction on the Singapore Stock Exchange (SGX). The risk of fast, automated executions has led many global exchanges, including NYSE Arca, NYSE American, and Nasdaq, to implement auction "collars" with others coming on line shortly1.

These collars set price thresholds to help to dampen auction price movement. However, the NYSE Opening Auction consistently outperforms electronic auctions, especially during volatile periods. The NYSE Closing Auction, which is more than 7.5% of total NYSE-listed trading activity, similarly outperforms other auctions.

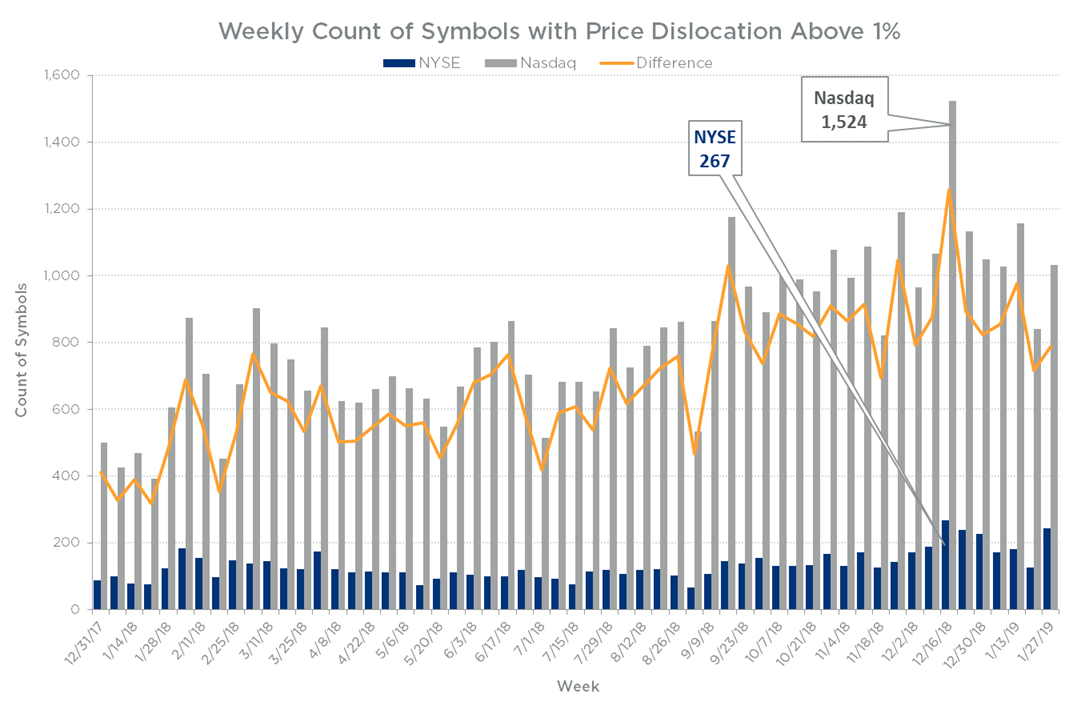

The chart below shows the weekly count of symbols that experienced price dislocations2 above 1% for both NYSE and Nasdaq Closing Auctions, and the difference between the two measures. As the chart shows, while auction price dislocation tends to increase during periods of heightened volatility, the dislocation in the NYSE Closing Auction is far less severe compared to the dislocation that occurs in the Nasdaq Closing Auction. This is attributable to the DMM's ability to help find relevant closing prices even in challenging market conditions3.

How Can This Help Traders & Investors?

- While Closing Auction volumes have grown in recent years, there is still substantial liquidity available that remains unexecuted near the closing auction price. Investors and traders can benefit from this additional liquidity with relatively less impact than during intra-day trading (we'll update this analysis in a forthcoming post).

- NYSE is planning to list exchange-traded products (ETPs) on the NYSE, to deliver the DMM's improved market quality performance to this fast-growing asset class.

2 Price dislocation is defined at the difference in basis points between the Closing Auction price and the market volume-weighted average price in the 5 minutes before the close.

3 Source: NYSE TAQ