July 15, 2019

The NYSE closing auction is the busiest time in the US equity market trading day. On average, nearly 300 million shares, or just over 8% of total NYSE-listed volume, are executed in the NYSE closing auction. As the only open outcry trading floor for equities, NYSE combines sophisticated technology and human judgment for the smooth functioning of this auction.

One way to access the Closing Auction’s liquidity is through an order type that replicates a Floor Broker’s manual interaction by including discretionary pricing instructions. This order type is currently known as the “d-Quote”, and as the NYSE migrates NYSE-listed trading to the Pillar technology platform in August 2019, it will become known as the “D Order”. For participation in the closing auction, its function will remain the same; it can be used intraday, or a Floor broker can designate that the discretionary pricing instructions will be active only for the closing auction, which will be known as a “Closing D Order”. Closing D Orders provide additional flexibility for auction interaction.

Below is an overview of the Closing Auction order types and functionality, highlighting the use of Closing D Orders.

Closing Auction Order Types1

- Market-on-Close (MOC): an unpriced order to buy or sell a security at the closing price that is guaranteed to fill

- Limit-on-Close (LOC): an order which sets the maximum price an investor is willing to pay, or the minimum price for which an investor is willing to sell, in the closing auction. An LOC order priced better than the final closing auction price is guaranteed to receive an execution.

- After 3:50 p.m., MOC and LOCs can be entered only to offset a published imbalance; they can be cancelled only for a legitimate error up to 3:58 p.m. and cannot be cancelled for any reason in the last two minutes of trading

- Closing Imbalance Offset Order (“Closing IO Order”): an order that participates in the closing auction only to offset an imbalance

- Closing D Order: allows customers access to the auction via Floor Brokers. Closing D Orders can be used as a flexible tool for accessing Closing Auction liquidity because such orders are eligible to participate in the closing auction up or down to a designated undisplayed price

- There are no restrictions on which side of the market a Closing D Order may be entered and upon migration to Pillar Closing D Orders can be entered and cancelled up to 3:59:50 p.m.

- Imbalance flips often occur as traders enter orders on both sides of the market in response to outsized available liquidity; these flips tend to result in larger auction volumes

- Only NYSE Floor Brokers can submit D Orders and Closing D Orders

- Exchange fees for Closing D Orders are $0.0003 per share if entered before 3:35 p.m.

1Order types are shown using forthcoming Pillar order type names

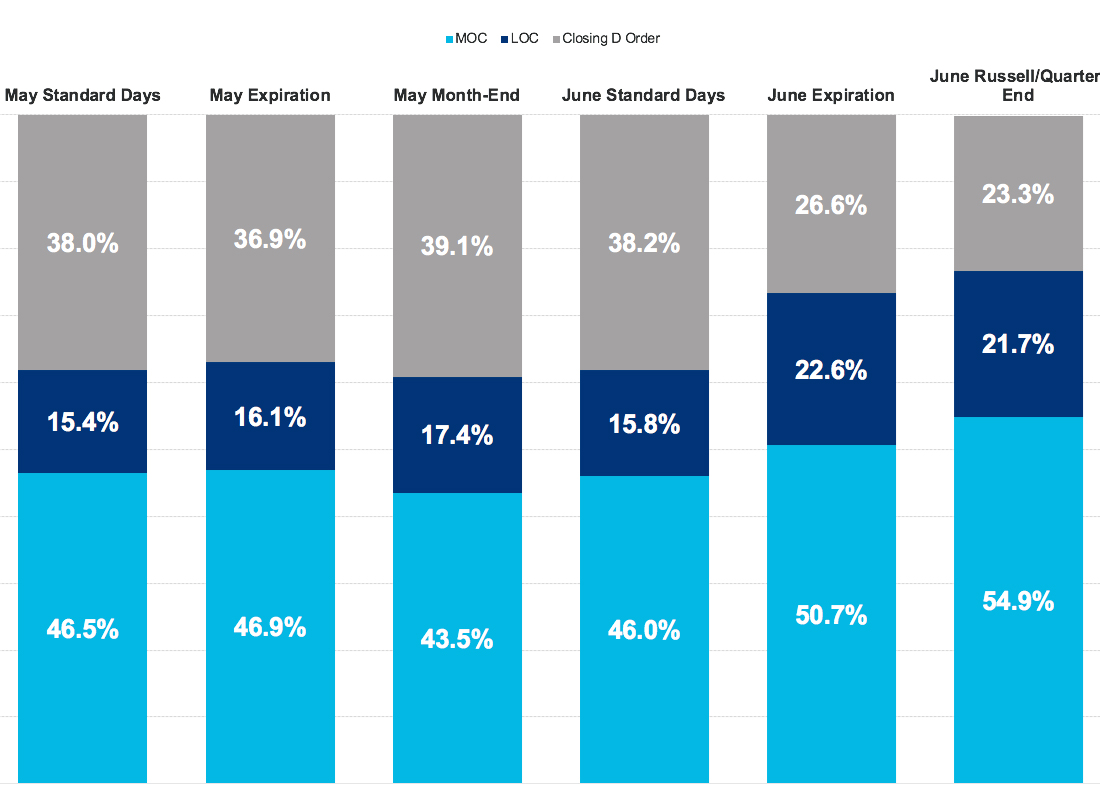

Order Type Usage

On average, Closing D Orders have accounted for approximately 35% of total NYSE Closing Auction volume. We see lower share for these orders on event days such as rebalances and month-ends, due to the huge influx of MOC & LOC orders on these days. This indicates that a very high share of volume on these days is trading on the close due to an event, meaning that there are additional opportunities for traders to discover outsized liquidity on these days (see related post on this topic).

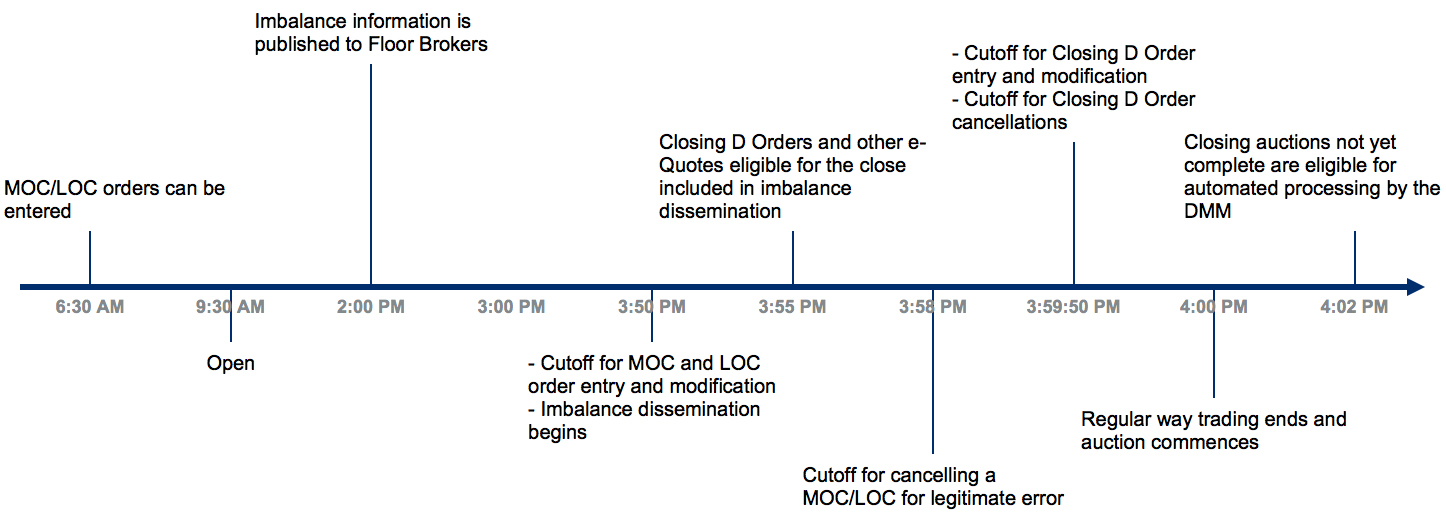

Closing Auction Timeline

Auction Transparency

Beginning at 3:50 p.m., NYSE publicly disseminates closing auction order imbalance information, providing information about the level of buyers and sellers in a particular security. At 3:55 p.m., the NYSE includes Closing D Orders in the closing auction order imbalance information. The imbalance data currently updates as frequently as every 5 seconds; when NYSE completes its migration to Pillar the frequency will increase to as much as every 1 second.

Key data points include:

| Imbalance Side | Buy/sell direction of imbalance shares |

|---|---|

| Reference Price | Used to calculate Continuous Book Clearing Price (generally last sale) |

| Paired Quantity | Number of shares matched at the Continuous Book Clearing Price |

| Continuous Book Clearing Price | Price where all better-priced orders on the side of the imbalance could be traded |

Key Takeaways

- Closing D Order usage has grown over time and accounts for approximately 35% of Closing Auction volume

- Closing D Orders, used via a NYSE Floor Broker, allow maximum flexibility in Closing Auction participation

- Closing D Orders’ relatively lower share of auction volume on event days suggests there are opportunities to increase D Orders and discover outsized liquidity

- All NYSE members can maintain or establish a floor presence; members, non-members, institutional investors, and other market participants can access D Orders via NYSE floor brokers (see our NYSE broker directory)