April 16, 2019

Depth of Closing Auction Book

- We’ve previously highlighted the large amount of liquidity that does not execute in the Closing Auction and is priced near the closing price

- We continue to see substantial additional depth at nearby price points that does not execute in the Closing Auction

- These unexecuted adjacent shares are an opportunity for traders to create a liquidity event by either loosening limit prices on Limit-on-Close (LOC) orders or providing further discretion to their floor brokers

- In addition to LOC orders, the displayed book at the end of the day also reveals meaningful opportunities to execute block-size liquidity with minimal impact

Aggregate Interest Near The Closing Price

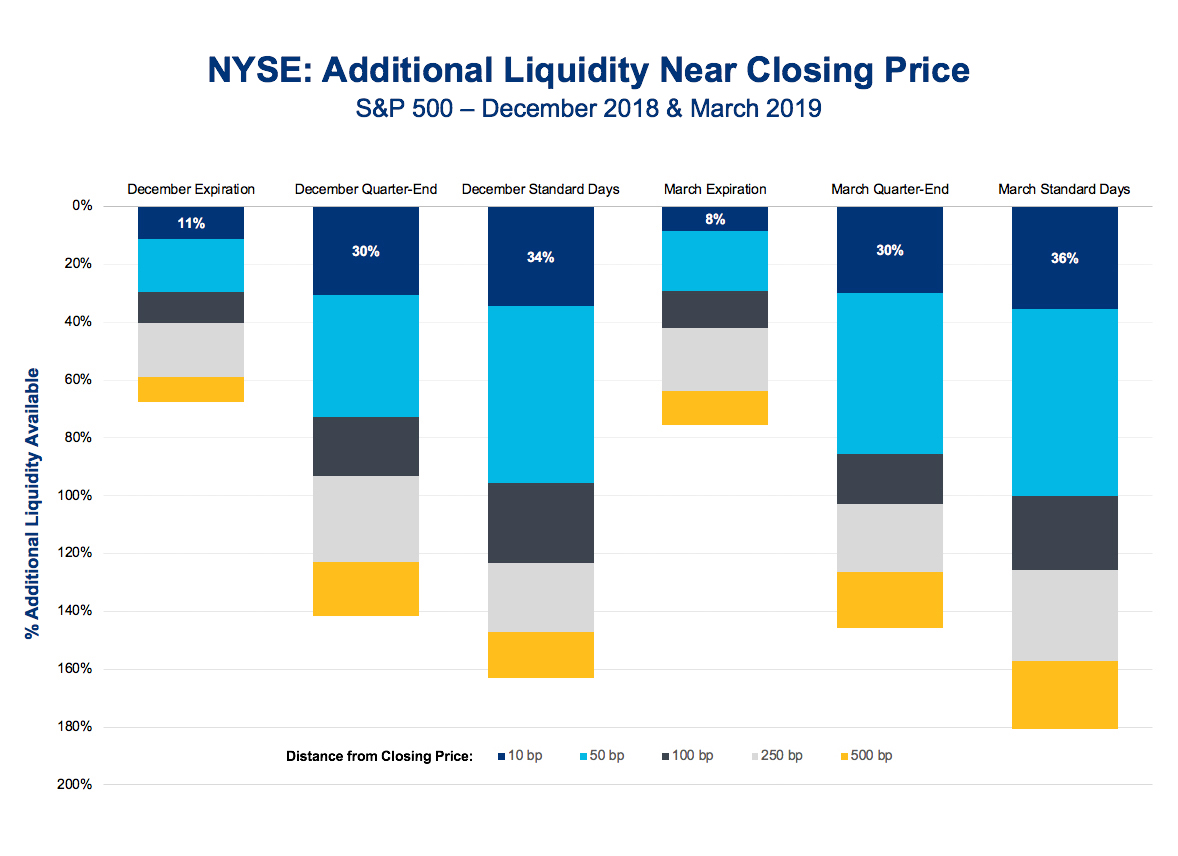

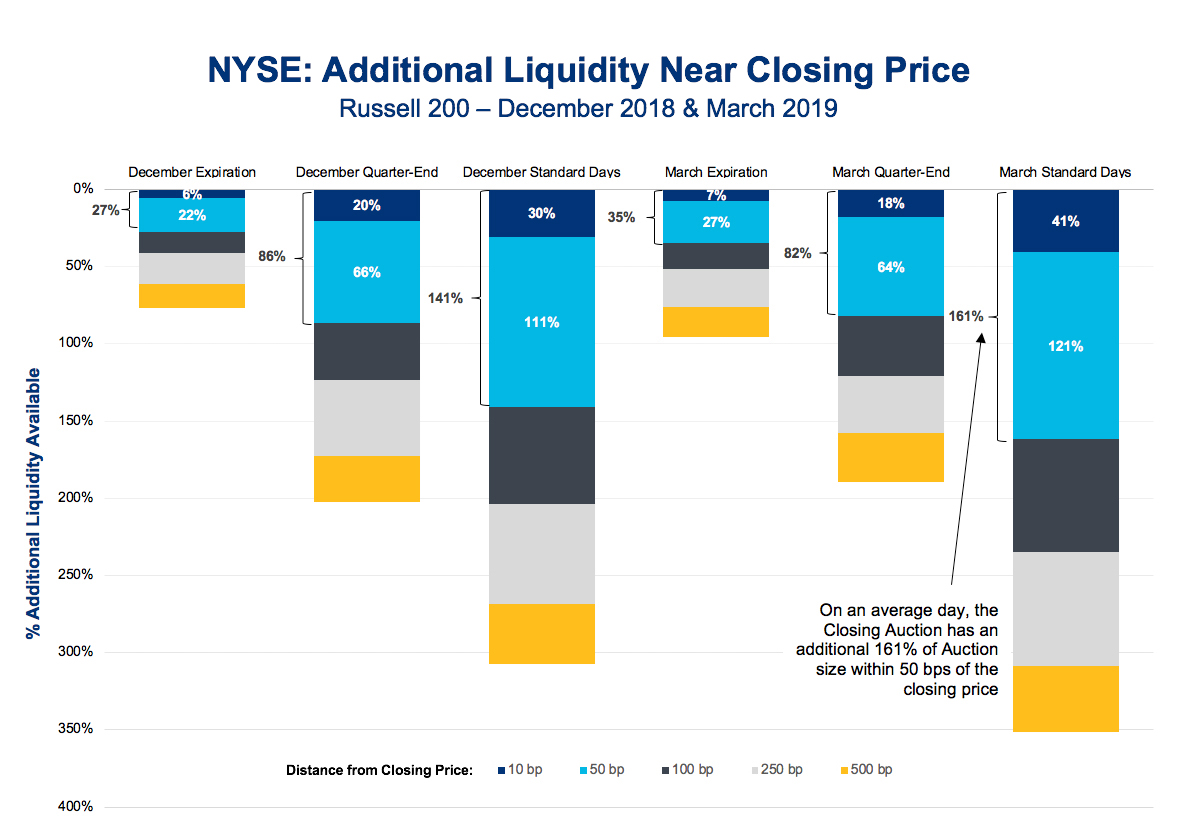

The charts below show the aggregate unexecuted interest available during the Closing Auction near the closing price for specified trading days. By sending orders with looser limit prices, traders may gain access to substantially more volume with only minimal impact to the closing price.

For example, in the S&P 500, 36% more volume could have traded within 10 basis points (bp) of the closing price on an average day in March. In the Russell 2000, 161% more volume could have traded within 50 bp of the closing price.

Displayed Interest

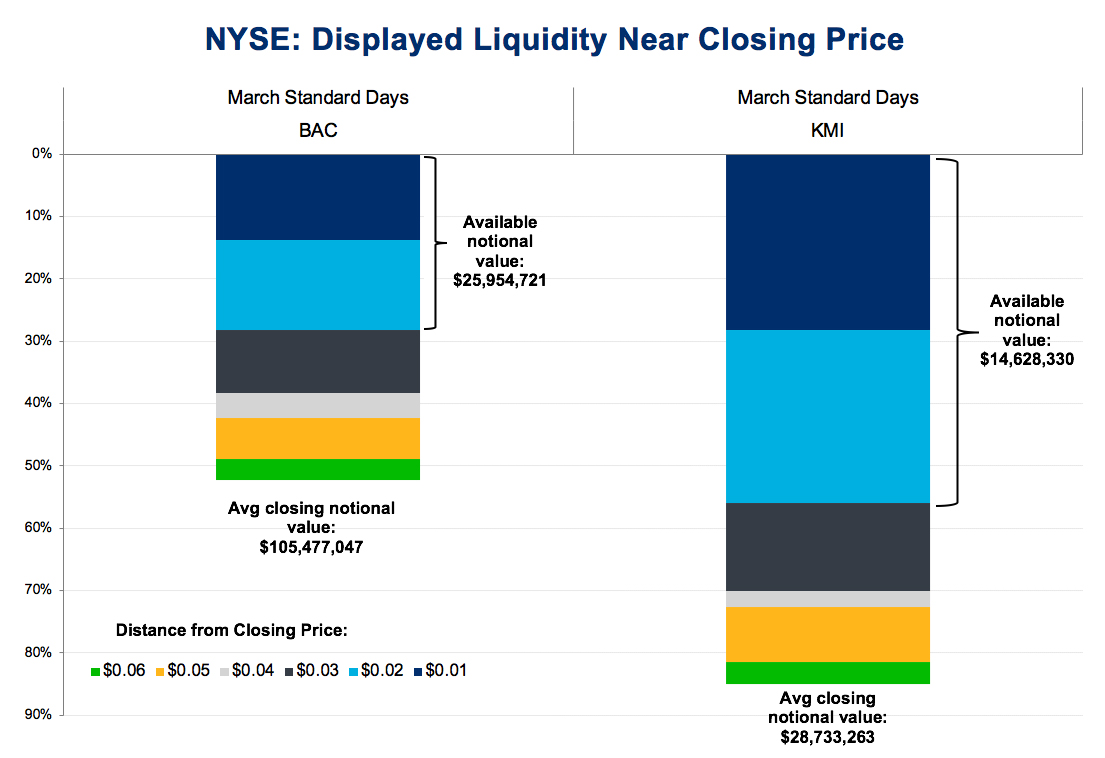

The above charts show all interest, both displayed and non-displayed (such as LOC orders). Additionally, monitoring the displayed depth on the NYSE leading into the Closing Auction can reveal substantial interest priced near the eventual close.

- The below chart shows displayed liquidity on NYSE immediately before 4:00 PM in two active names, BAC and KMI

- On an average day in March, BAC’s closing quote showed $26MM within $0.02 of the eventual closing price

- This closing quote alone was roughly 25% of the dollar value of the eventual Closing Auction

- KMI shows even larger relative size, with $14.6MM available within $0.02 of the eventual closing price, 51% of the eventual auction volume

Conclusion: The Close is Big and Should Be Bigger

The Closing Auction accounts for more than 8% of NYSE-listed volume thus far in 2019. As the above data shows, the auction’s liquidity has attracted a deep book of opportunistic volume priced near the eventual closing price. This creates unique liquidity opportunities for traders to execute block-size liquidity with minimal impact by entering LOC orders with looser limit prices or providing further discretion to their floor brokers.