June 3, 2020

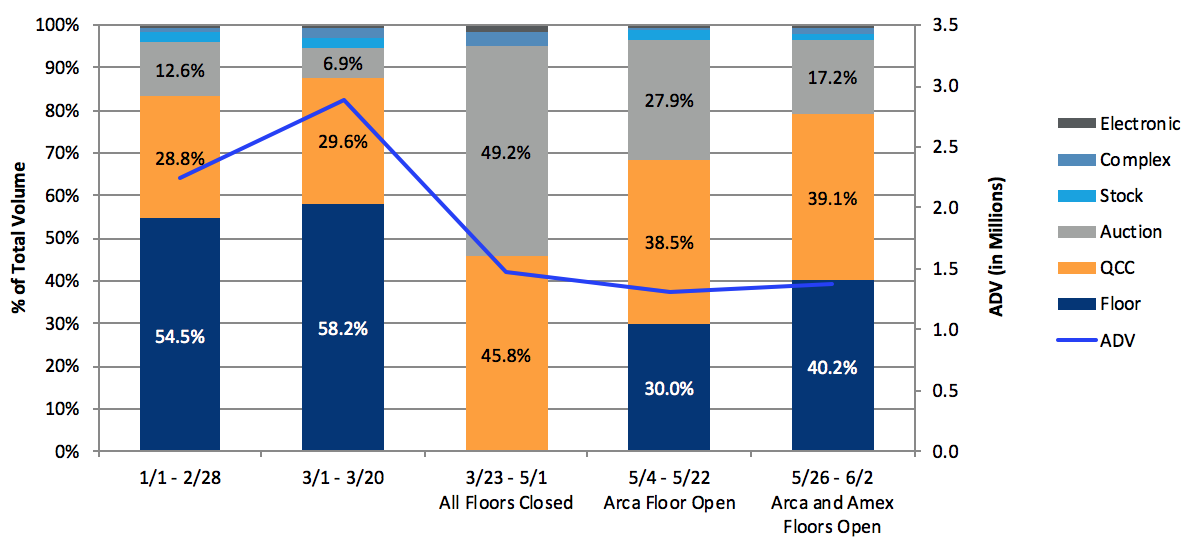

Last month, the NYSE American and Arca Options Trading Floors partially reopened with reduced headcount and new safety protocols. Following this, open outcry is now back to about half of its pre-Floor closure share of total market volume. Open outcry volume appeared to be drawing volume away from Auction, Complex, and Electronic trades.

| All Floors Closed | Arca Open | American Reopens | ||

| Jan 1 - Mar 22 | Mar 23 - May 3 | May 4 - May 25 | May 26 - Jun 2 | |

| Auction | 17.1% | 23.6% | 24.5% | 23.9% |

| Complex | 13.0% | 12.6% | 12.0% | 11.6% |

| Electronic | 54.9% | 58.1% | 55.3% | 55.2% |

| Floor | 9.5% | 0.2% | 3.5% | 4.5% |

| QCC | 4.4% | 4.7% | 4.0% | 4.1% |

| Stock | 1.0% | 0.7% | 0.8% | 0.7% |

In large institutional-sized trades of 5,000 contracts or more, we saw that Auction share, which had benefitted the most from the Floor closures, declined to near pre-Floor closure levels. It appeared these large trades were directed back to the Floors, however, the overall volume of large trades has not recovered to pre-closure levels.

Industry Trade Type Share

Trade >= 5,000 Contracts

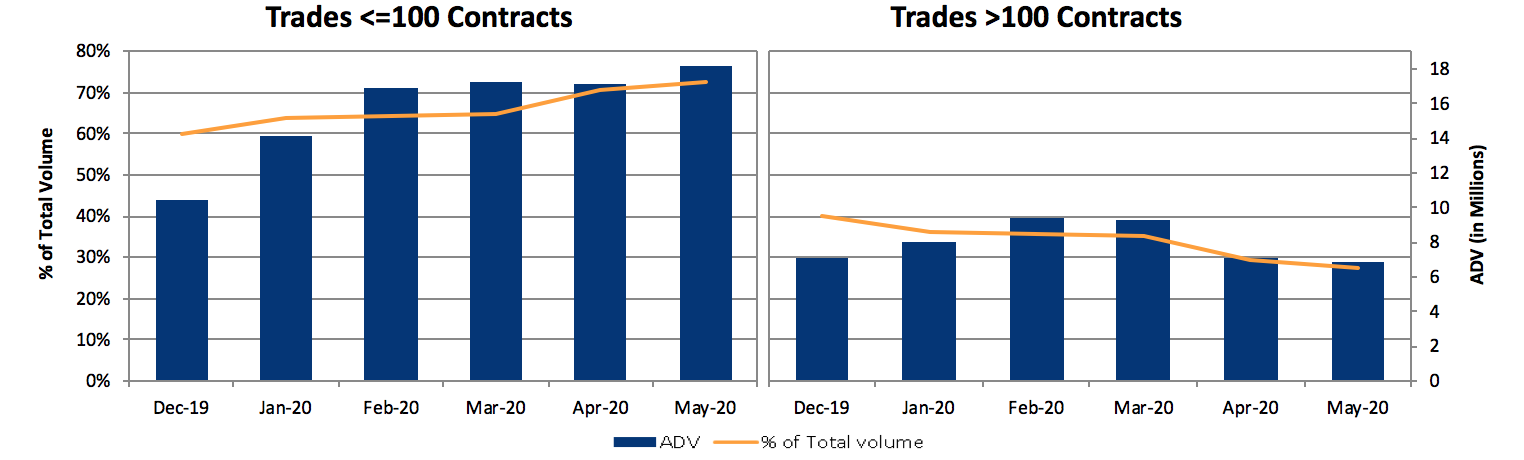

We observed that volume in trades greater than 100 contracts is at six-month lows compared to trades of 100 contracts or fewer, which are at record highs. This is indicative of growth in retail volume as a proportion of industry volume that does not typically trade in open outcry.

Industry Volume Distribution by Trade Size

The reopening of the NYSE Amex and Arca Options Trading Floors started a healthy migration of options trading back to open outcry. However, even at these elevated industry volume levels, large institutional-sized trades have not fully returned to the market. We anticipate continued growth in open outcry trading as these trades begin to return to the market.